MARPOL Detention Cost Insurance (MDCI)

Protecting Operators, Crews and Business Continuity

In today’s regulatory environment, compliance alone is no longer enough.

When a MARPOL investigation or detention occurs, it can expose shipowners and managers to significant, unbudgeted costs — even when no wrongdoing has been proven.

ShorelineHudson’s MDCI coverage provides financial and operational protection, ensuring your vessels, crews, and reputation remain safeguarded throughout.

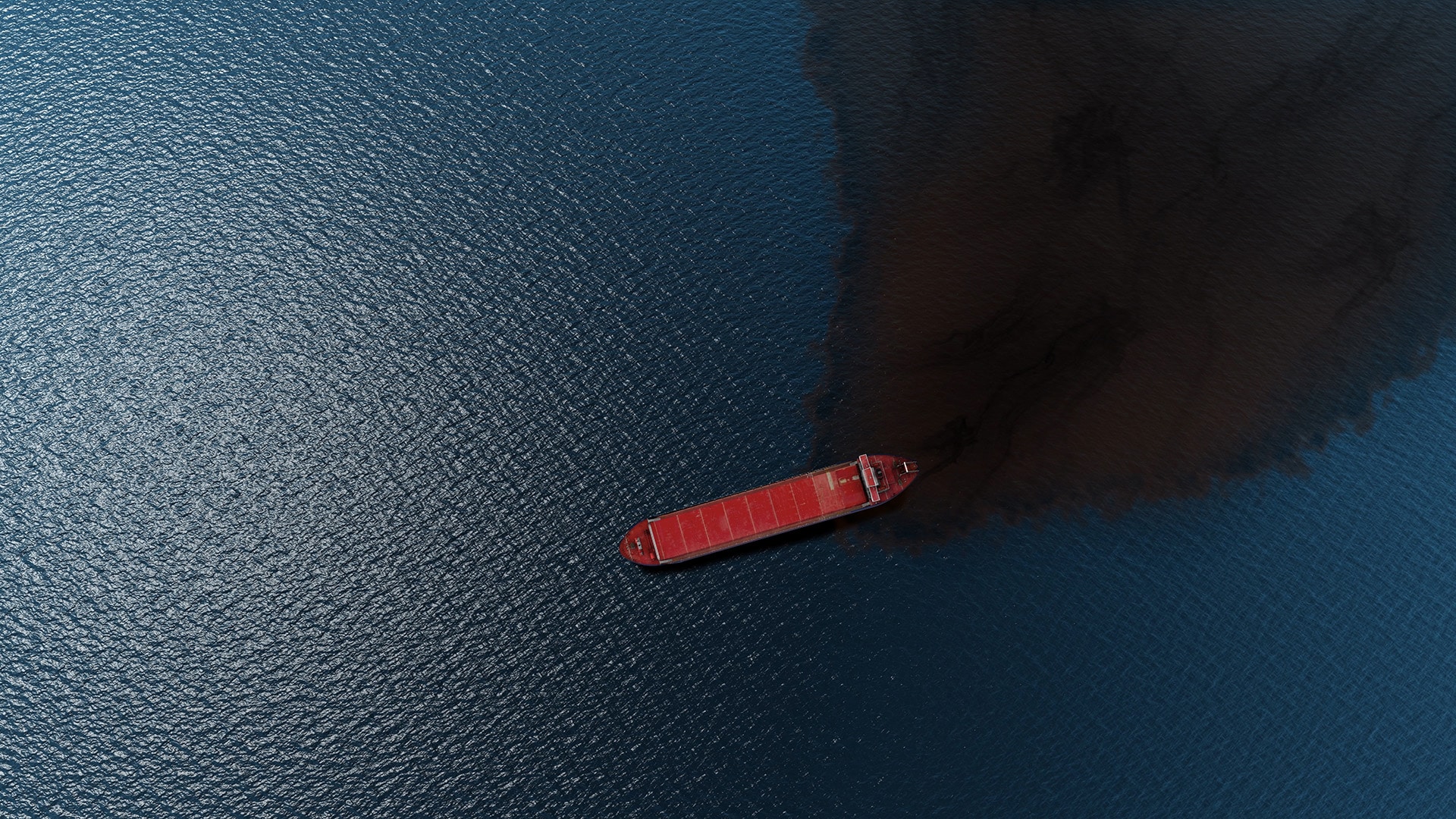

The Challenge

MARPOL enforcement has intensified in recent years.

Across U.S. ports — particularly since the Dali bridge allision — foreign-flagged vessels are facing increased scrutiny from the U.S. Coast Guard and Department of Justice.

A single allegation of non-compliance can lead to:

- Vessel detention and loss of hire

- Prolonged investigation costs

- Crew interviews, travel restrictions, and repatriation expenses

- Legal representation requirements both ashore and at sea

- Operational disruption and reputational damage

Even when a shipowner or operator is found not guilty, the costs incurred to reach that outcome are substantial — and the indemnification of such losses is generally discretionary under traditional marine insurance policies.

The Gap in Traditional Cover

Most P&I Clubs and conventional insurance products do not routinely cover the commercial losses or defense costs associated with MARPOL-related detentions.

They respond only after liability has been established — leaving operators to manage significant interim costs themselves.

MDCI bridges that gap by providing affirmative cover for the immediate and practical consequences of a MARPOL detention, regardless of eventual outcome.

The Solution – MDCI

MARPOL Detention Costs Insurance (MDCI) provides assured financial protection for vessel owners, operators and managers facing environmental detentions in the U.S., ensuring access to expert legal assistance and recovery of detention-related expenses.

Each policy provides:

- US$1 million of combined annual coverage per vessel

- Ground-up cover with no deductible — protection starts from the first dollar lost

- Primary indemnity for detention-related costs, with a waiver of any rights of recovery from other policies of marine insurance

- Guaranteed access to leading U.S. maritime counsel for onboard investigation and crew legal representation

MDCI ensures that operators can meet regulatory challenges with preparedness, financial resilience, and the right support from day one.

Key Coverage Benefits

- Legal Response Costs – U.S. legal representation, investigation, and evidence management

- Vessel Detention Expenses – Loss of hire, and related operational costs

- Crew-Related Costs – Legal and maintenance expenses, travel, accommodation, and substitution costs

- Affirmative Coverage – No discretion or ambiguity; coverage applies automatically when triggered

Why Choose ShorelineHudson

- Affirmative, Not Discretionary – Unlike discretionary covers, MDCI provides contractual certainty from day one of your vessel’s detention in the U.S.

- ESG-Aligned Protection – Demonstrates a commitment to crew welfare and responsible governance — increasingly recognized in ESG audits.

- U.S. Market Expertise – Developed in partnership with and supported by Chalos & Co., a leading U.S. maritime law firm.

- Integrated Compliance Ecosystem – Designed to complement ShorelineHudson’s COFR, QI, and risk management services.

- Fixed Premium Structure – Predictable pricing and straightforward opt-in administration.

The MDCI Client Protection Scheme

Exclusive to ShorelineHudson clients, the MDCI Client Protection Scheme allows vessel owners and managers to secure coverage in advance — at no cost until trading to the U.S.

Key Features:

- US$1 million annual coverage per vessel at a fixed rate of US$500 per vessel, per year

- Pay-as-you-trade – enrollment if free, no premium due until a U.S. port call is made

- Simple opt-in process – a single fleet declaration replaces lengthy applications

- Automatic documentation – electronic policies issued upon activation

- Legal support assurance – guaranteed access to discounted legal fees through Chalos & Co.

Opt in today to ensure your vessels are protected when trading to the U.S., with nothing to pay until you do.

Email [email protected] or contact your ShorelineHudson account manager for details.

Technical Q&A

MARPOL Detention Costs Insurance (MDCI) is a dedicated insurance product developed to cover the operational, legal, and crew-related costs incurred during MARPOL-related detentions, investigations, or allegations in the U.S.

MDCI is designed for shipowners, operators, and managers of foreign-flagged vessels trading to the United States or other jurisdictions where MARPOL enforcement is actively prosecuted.

- P&I responds to liabilities once established.

- MDCI responds to events — providing immediate cover for detention costs, investigations, and crew-related expenses, even where liability has not been determined.

It complements, rather than replaces, P&I insurance.

- Legal response and investigation costs

- Loss of hire and port-related detention costs

- Crew travel, accommodation, and substitution expenses

MDCI provides a US$1 million combined annual limit per vessel, applying across all covered cost categories.

No. MDCI provides ground-up cover, meaning coverage starts from the first dollar lost.

No. The policy excludes fines and criminal defense costs.

MDCI covers insurable losses and expenses permitted under U.S. law.

MDCI strengthens ESG performance by:

- Ensuring crew welfare through immediate legal representation and support

- Demonstrating responsible governance through proactive risk transfer

- Promoting ethical conduct by separating criminal liability from insurable loss

Why choose ShorelineHudson for MDCI?

- Proven U.S. regulatory experience

- Product designed with input from U.S. maritime law experts

- Direct integration with COFR, QI, and vessel attendance programs

- Simple, transparent administration

- Fixed premium and opt-in convenience