Marine Cyber Insurance (MCI)

Digital navigation, cargo systems, and shoreside operations are now mission-critical. When cyber events disrupt bridge systems, operational technology (OT) networks, or voyage data, the impact is not just technical—it’s commercial.

ShorelineHudson connects clients to London-market cyber insurers through Acrisure’s London Wholesale platform, backed by HudsonCyber and Acrisure Cyber Services (ACS). Together, we provide access to specialized cover and hands-on cyber risk management expertise that helps protect both assets and operations.

The Challenge

GNSS jamming and AIS spoofing have become regular operational hazards in multiple regions, from the Black Sea to the Persian Gulf and East Asia.

As these incidents increase, shipowners face heightened concern over the intersection between cyber and physical risk — particularly where navigation integrity, port systems, or voyage continuity are at stake.

At the same time, most conventional marine policies now include cyber exclusions under clauses such as LMA5402 and LMA5403.

This leaves shipowners uncertain as to what’s covered, what’s excluded, and how to respond when an incident occurs.

Without dedicated cyber coverage or expert risk management, this uncertainty can translate into financial loss, operational delay, and reputational exposure.

The Solution — Coordinated access to the London cyber insurance market

part of Acrisure, ShorelineHudson serves as a conduit between our clients and the London cyber insurance market via our Acrisure London Wholesale colleagues.

We organize and present marine cyber submissions to specialist London-market underwriters offering:

- Property and liability buy-backs for excluded cyber perils within hull, machinery, and P&I policies;

- Standalone marine cyber insurance covering digital and operational disruption;

- Navigation integrity coverage for GNSS jamming and AIS spoofing events.

In parallel, we deliver integrated cyber risk management through:

- HudsonCyber – maritime cyber resilience assessments, maturity roadmaps, and compliance programs led by Max Bobys;

- Acrisure Cyber Services (ACS) – a global 24/7/365 managed cyber and IT security team of over 300 professionals, providing monitoring, response, and advisory support.

This dual approach, combining insurance placement with proactive risk management, strengthens both your security posture and your insurability.

We can assist with the following:

- Standalone Marine Cyber Cover – first- and third-party risks including incident response, forensics, data restoration, network business interruption, and cyber extortion.

- Buy-Backs and Carve-Backs – reinstating limited cyber coverage within H&M or P&I placements.

- Navigation Integrity Endorsements – protection for GNSS jamming and AIS spoofing, addressing deviations, delays, or groundings.

- Operational Technology (OT) and Shoreside Cover – extending protection to port, cargo, and systems integration environments.

Why ShorelineHudson

- Market Access, Simplified – Single-point coordination with Acrisure London Wholesale for London-market placements.

- Risk + Insurance, integrated – Hudson Cyber and ACS services reduce exposure and enhance claims mitigation strategies.

- Marine Specialization – Seamless alignment across hull, P&I, war, and cyber coverages.

- Clarity and Confidence – Guidance through exclusions and response scenarios to achieve full coverage certainty.

Technical Q&A

It provides financial and operational protection following cyber incidents that disrupt OT or IT systems.

Coverage includes incident response, forensics, data restoration, network business interruption, cyber extortion, and third-party liability — while clarifying what’s excluded under traditional policies.

Threats linked to geopolitical tension — especially GNSS jamming, AIS spoofing, and supply chain compromise — are currently the most scrutinized by insurers due to their ability to trigger physical and commercial losses simultaneously.

ShorelineHudson prepares submissions and coordinates directly with Acrisure London Wholesale, which accesses specialist London cyber underwriters.

This ensures competitive pricing and tailored policy structures aligned to your particular marine cyber risk profile.

Yes. Hudson Cyber delivers maritime-specific assessment, training, and compliance support.

Acrisure Cyber Services (ACS) provides continuous managed detection and response through its 300+ person global cybersecurity team as a dedicated MSP, offering incident response and advisory services 24/7/365.

No. While Shoreline’s MISL cyber underwriting facility was paused in 2022, we now access cyber capacity through Acrisure’s London Wholesale platform — combining placement expertise with our internal cyber risk management capability.

- Fleet and vessel details

- Trading areas and voyage frequency

- IT/OT network structure and vendor dependencies

- Cybersecurity controls (e.g., backups, MFA, EDR, incident response)

- Historical incidents and continuity plans

ShorelineHudson assists clients in preparing submissions that meet market expectations.

For straightforward cyber placements with established controls, terms can be obtained within days.

Custom navigation-integrity endorsements (e.g., for GNSS/AIS events) may require additional review by the underwriter.

We analyze all cyber exclusions and overlaps across H&M, P&I, war, and standalone cyber policies to ensure no coverage gaps and clear claims pathways.

Who can we contact?

Email [email protected] or call +1 441 296 2324 to connect with a ShorelineHudson Marine Cyber Insurance Specialist.

We’ll coordinate discussions with Acrisure London Wholesale, Hudson Cyber, and Acrisure Cyber Services to build the right solution.

You might also be interested in

USA OPA90 COFR Guarantees

U.S. law requires all vessels trading in its waters to maintain a Certificate of Financial Responsibility (COFR) backed by guaranty from an approved guarantor. Without which, vessels are denied entry to U.S. ports. Acting on behalf of MISL, ShorelineHudson provides strict-liability guarantees that satisfy U.S. OPA90 regulatory requirements. With decades of experience, we are the international shipowner’s trusted partner for U.S. COFR compliance.

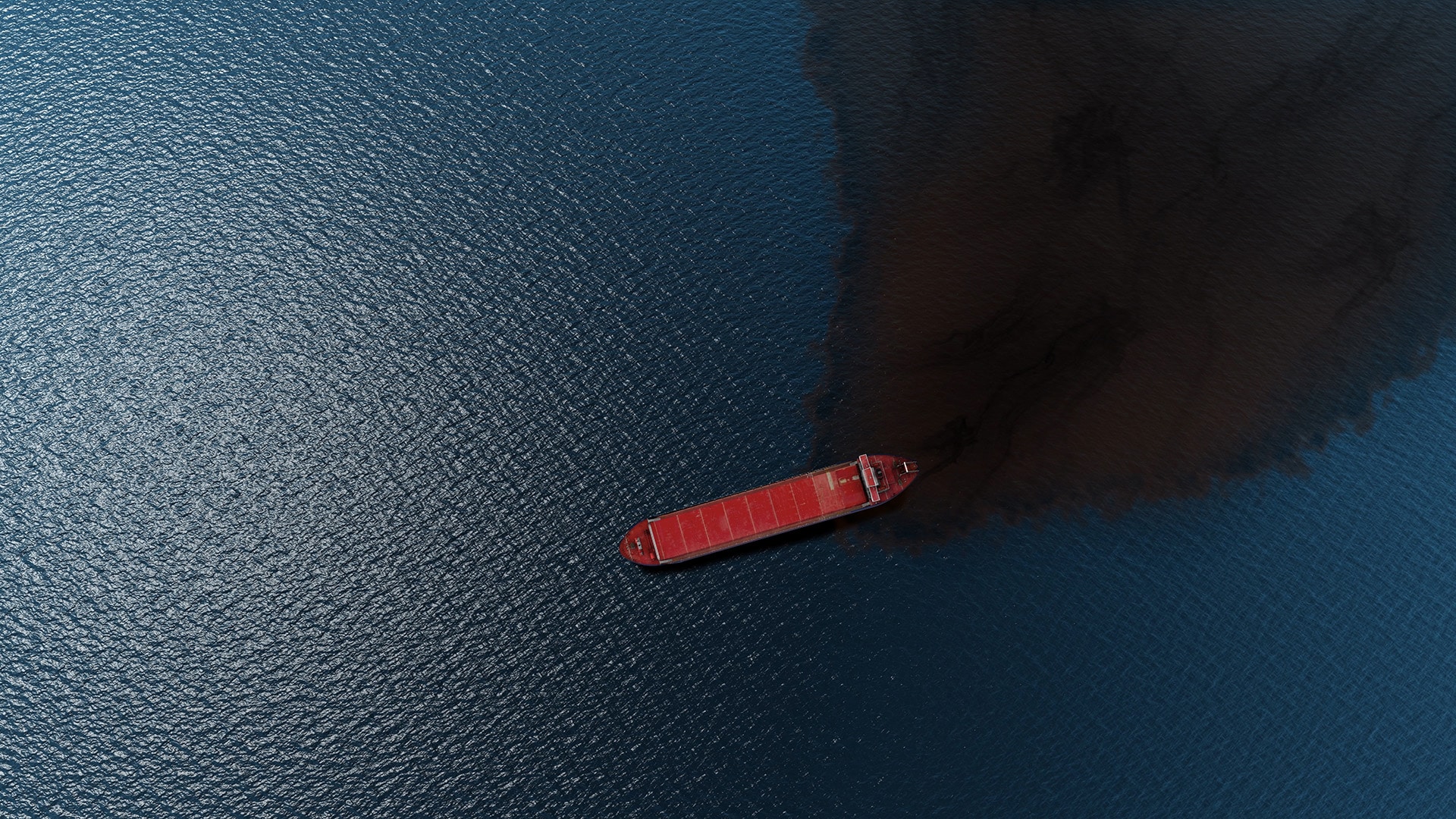

MARPOL Detention Cost Insurance (MDCI)

MARPOL enforcement actions can result in vessel detentions and significant unplanned costs, including legal fees, crew-related expenses, and loss of hire. ShorelineHudson’s MDCI is the market’s first dedicated affirmative insurance solution, offering up to USD 1 million of cover, for unbudgeted operational costs. It complements P&I insurance by directly addressing the operational risks of detention and delay following routine U.S. port state inspections.

North American Carrier Bonds

Your License to Trade Freely Across U.S. and Canadian Ports. Every voyage to North America begins long before a ship reaches port. Behind every successful port call lies the assurance that customs documentation, bond filings, and carrier registrations are in order. For shipowners, managers, and operators, the challenge isn’t just compliance — it’s confidence.

Athens War Blue Card Insurance

For cruise lines and ferry operators, passenger liability compliance isn’t optional — it’s mandatory regulatory compliance.