Insurance

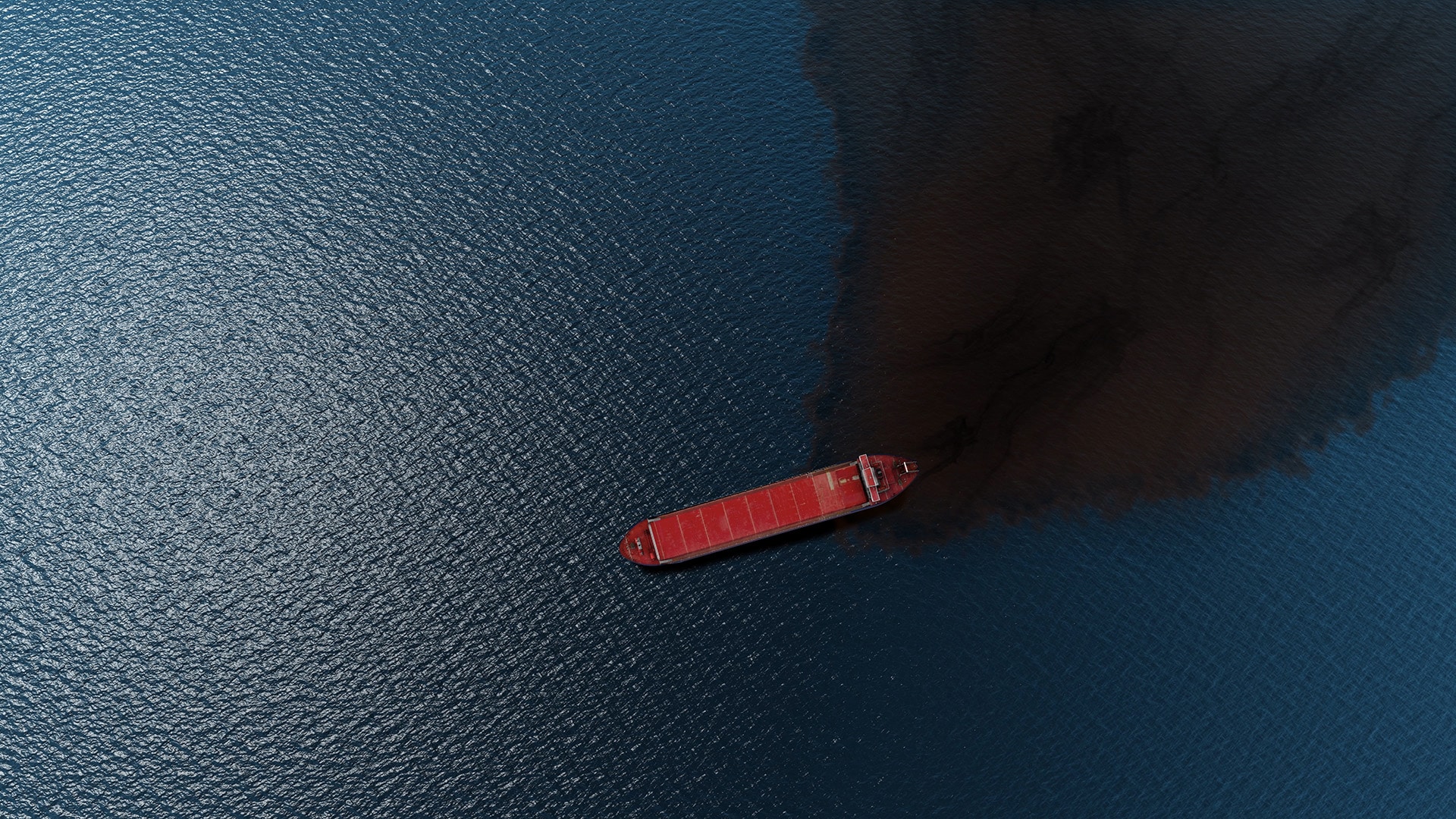

World events, from the Exxon Valdez oil spill in Alaska to the ship and port security regulatory reforms following the 9/11 terrorist attack in New York, have reshaped maritime regulation and placed new compliance obligations on international shipowners. Today, operators must demonstrate clear financial responsibility for environmental and human risks when trading in U.S. and EU waters.

For over three decades, MISL, managed by Shoreline and now ShorelineHudson, has acted as a trusted guarantor. We deliver the financial guarantees required for regulatory compliance, ensuring obligations are met and vessels retain uninterrupted trading access to U.S. and EU ports.

Insurance Solutions

USA OPA90 COFR Guarantees

U.S. law requires all vessels trading in its waters to maintain a Certificate of Financial Responsibility (COFR) backed by guaranty from an approved guarantor. Without which, vessels are denied entry to U.S. ports. Acting on behalf of MISL, ShorelineHudson provides strict-liability guarantees that satisfy U.S. OPA90 regulatory requirements. With decades of experience, we are the international shipowner’s trusted partner for U.S. COFR compliance.

MARPOL Detention Cost Insurance (MDCI)

MARPOL enforcement actions can result in vessel detentions and significant unplanned costs, including legal fees, crew-related expenses, and loss of hire. ShorelineHudson’s MDCI is the market’s first dedicated affirmative insurance solution, offering up to USD 1 million of cover, for unbudgeted operational costs. It complements P&I insurance by directly addressing the operational risks of detention and delay following routine U.S. port state inspections.

North American Carrier Bonds

Your License to Trade Freely Across U.S. and Canadian Ports. Every voyage to North America begins long before a ship reaches port. Behind every successful port call lies the assurance that customs documentation, bond filings, and carrier registrations are in order. For shipowners, managers, and operators, the challenge isn’t just compliance — it’s confidence.

Athens War Blue Card Insurance

For cruise lines and ferry operators, passenger liability compliance isn’t optional — it’s mandatory regulatory compliance.

Marine Cyber Insurance (MCI)

Cyber risk is both a regulatory and operational reality. ShorelineHudson’s bespoke Marine Cyber Insurance provides affirmative cover against business disruption, liability, and regulatory penalties while supporting compliance with emerging cyber risks such as GNNS jamming and AIS spoofing. This protection safeguards both operational resilience and corporate reputation.

Find Your Solution

Need a U.S. OPA 90 COFR to trade to U.S. ports?

Understand COFR limits, eligibility, and how ShorelineHudson can issue and maintain your U.S. COFR without delay or disruption.

Concerned about MARPOL inspections and detention risk in the U.S.?

See how MDCI protects against the unbudgeted costs that arise when regulatory scrutiny escalates during U.S. port calls.

Need a bond to release cargo or secure customs compliance?

Learn how International Carrier Bonds work and how we arrange them quickly to keep cargo moving and avoid unnecessary delay.

Worried about cyber incidents affecting vessel operations or compliance?

Explore marine cyber insurance solutions designed for navigation systems, regulatory exposure, and operational disruption.