North American Carrier Bonds

Your License to Trade Freely Across U.S. and Canadian Ports. Every voyage to North America begins long before a ship reaches port. Behind every successful port call lies the assurance that customs documentation, bond filings, and carrier registrations are in order.

US ICB Application

For shipowners, managers, and operators, the challenge isn’t just compliance — it’s confidence.

- Confidence that your vessels won’t be delayed

- Confidence that your paperwork won’t be questioned

- Confidence that your business continues without interruption

That’s where ShorelineHudson comes in.

Why You Need a Carrier Bond

Before a vessel can enter U.S. or Canadian waters, customs authorities require financial guarantees — known as Carrier Bonds — to ensure operators file their cargo, passenger, or crew manifests correctly.

Without the appropriate bond in place, vessels risk:

- Port delays or denied entry while bond status is verified

- Administrative penalties for incorrect or missing manifest filings

- Loss of trading reputation with charterers or agents

- Operational disruption that can cascade across the fleet

Two Countries. Two Systems. One Agent of Service.

United States – International Carrier Bonds (ICBs)

A U.S. ICB (CBP Activity Code 3) is required by U.S. Customs & Border Protection (CBP) for the entity filing manifests when entering U.S. ports.

Depending on the type of operation:

- Type 3A Bonds (US $20,000) – Passenger or non-cargo carriers (cruise lines, ferries, yachts) filing only APIS or crew data.

- Type 3 Bonds (US $100,000) – Cargo-carrying vessels filing electronic cargo manifests through CBP’s ACE system.

- Miami Bonds (US $150,000) – Higher bond amount required by CBP Miami for high-volume or repeat-call operators.

In short — if you file a manifest with CBP, you need an ICB.

Getting the bond type wrong can cause costly delays or unwanted scrutiny.

Canada – ACI Carrier Bonds

For calls to Canadian ports, carriers must comply with CBSA’s Advance Commercial Information (ACI) rules.

The ACI Carrier Bond (CAD $25,000) provides the financial assurance needed to transmit pre-arrival data through the CARM Client Portal (CCP).

Both systems serve the same purpose: to demonstrate trust and reliability to customs — ensuring your vessels continue to trade freely.

Where Things Go Wrong

Even experienced operators can stumble:

- Filing under the wrong entity (owner vs. manager vs. charterer)

- Selecting the incorrect bond type or amount

- Missing renewal dates or bond expiries

- Misalignment between CBP, CBSA, and surety documentation

These small oversights can result in unnecessary inspection holds, penalties, or loss of trading momentum.

How ShorelineHudson Helps

We make compliance simple.

Our team has decades of experience securing carrier bonds for every type of vessel, from cargo ships to cruise liners and private yachts.

We:

- Identify who within your corporate structure should hold the bond (owner, operator, or manager)

- Determine the correct bond type and amount

- Coordinate filings with CBP, CBSA, and surety partners

- Provide one point of contact for the entire North American region

The result: a compliant fleet, ready to trade without interruption.

Your Trusted Partner in North American Compliance

With ShorelineHudson, you gain more than a bond provider, you gain a trusted advisor.

We interpret the regulations, manage the filings, and protect your operational continuity.

Technical Q&A

An ICB is a financial guarantee required by U.S. Customs & Border Protection (CBP) from any carrier bringing goods, passengers, or crew into the United States.

It ensures compliance with customs requirements and covers potential penalties for incorrect or late filings.

An ICB is required for the entity responsible for manifest filing — usually the vessel operator.

| Party Type | ICB Required? | Notes |

| Vessel Owner | Yes | If they retain control and file manifests |

| Bareboat (Demise) Charterer | Yes | Treated as the operator under CBP |

| Pool Manager | Yes | If recognized as the carrier for customs purposes |

| Time Charterer | Possibly | If they assume manifest-filing responsibility |

| Voyage Charterer | No | Not considered the carrier |

| Bond Type | Amount | Required By | Purpose |

| Type 3A | US $20,000 | Passenger / non-cargo carriers | For vessels filing only APIS or crew data |

| Type 3 | US $100,000 | Cargo-carrying operators | For vessels filing cargo manifests through CBP’s ACE system |

| Miami Type 3 | US $150,000 | High-volume / Miami-based carriers | Higher limit required by the CBP Miami district |

The ICB guarantees payment of penalties or fines related to non-compliance with customs manifest requirements.

It does not cover cargo claims or pollution liabilities — those remain with the operator’s insurance.

ICBs are issued for a standard one-year period, renewable annually.

To submit electronic manifests, carriers require:

- A Standard Carrier Alpha Code (SCAC) issued by the NMFTA; and

- A CBP Carrier Code derived from that SCAC for use in the ACE system. Passenger-only (APIS) operators do not require a SCAC code.

The ACI Carrier Bond is a CAD $25,000 financial guarantee required by the Canada Border Services Agency (CBSA) to file pre-arrival information electronically under the Advance Commercial Information (ACI) program.

Carriers register via the CARM Client Portal, obtain a BN and RM program number, and provide details to ShorelineHudson and International Sureties for electronic approval and issuance.

Yes. Many operators hold both bonds under the same legal entity.

ShorelineHudson coordinates both applications to ensure consistent filings and renewals.

If ownership, management, or filing responsibility changes, ShorelineHudson updates the bondholder details and re-files as needed with CBP or CBSA to maintain compliance.

- U.S. and Canadian Coverage – One procurement agent for both jurisdictions

- Experienced Guidance – We determine which entity should hold the bond and the correct amount

- Responsive Support – Global coverage with U.S., Bermuda, and Greek offices

You might also be interested in

USA OPA90 COFR Guarantees

U.S. law requires all vessels trading in its waters to maintain a Certificate of Financial Responsibility (COFR) backed by guaranty from an approved guarantor. Without which, vessels are denied entry to U.S. ports. Acting on behalf of MISL, ShorelineHudson provides strict-liability guarantees that satisfy U.S. OPA90 regulatory requirements. With decades of experience, we are the international shipowner’s trusted partner for U.S. COFR compliance.

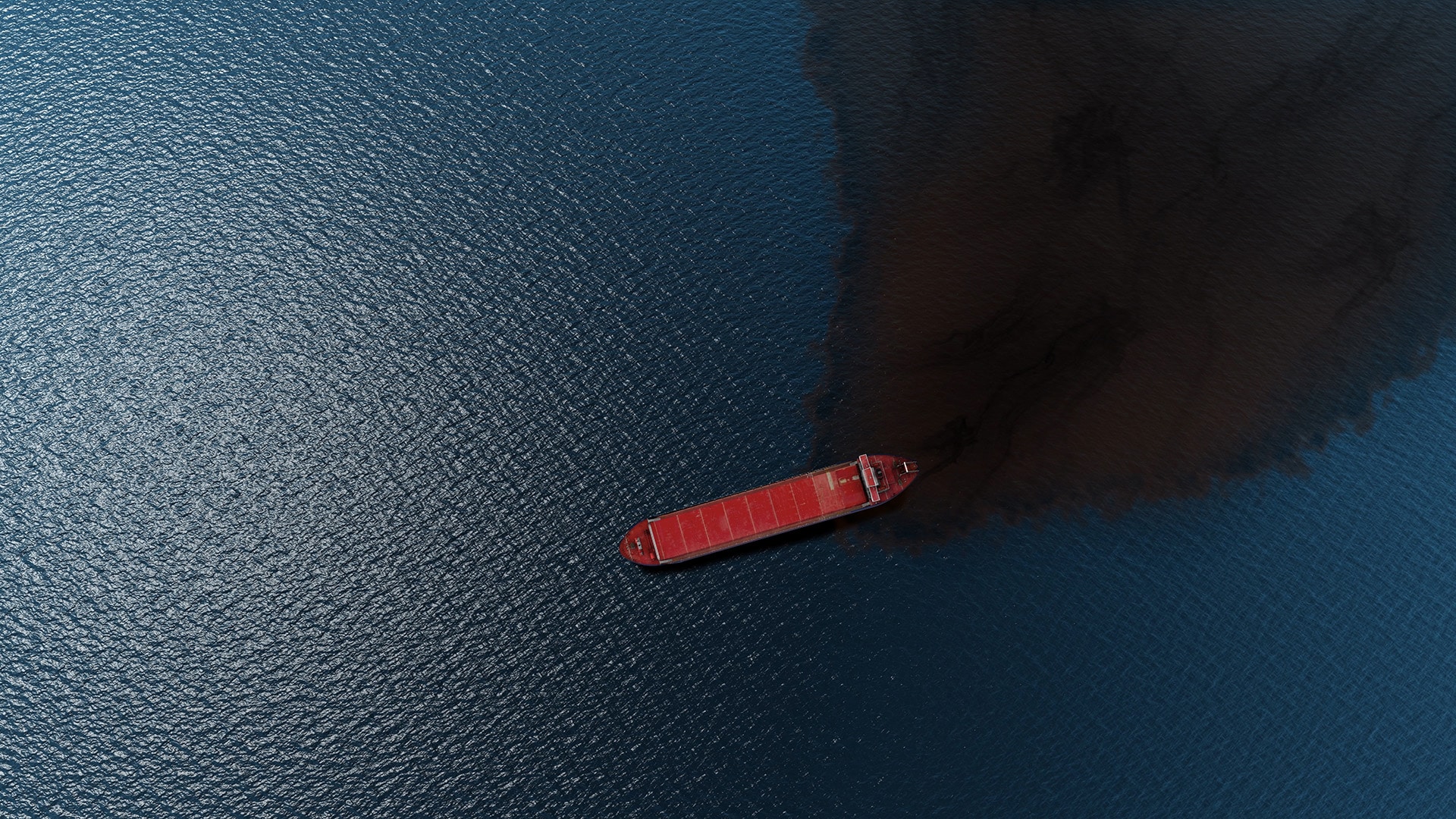

MARPOL Detention Cost Insurance (MDCI)

MARPOL enforcement actions can result in vessel detentions and significant unplanned costs, including legal fees, crew-related expenses, and loss of hire. ShorelineHudson’s MDCI is the market’s first dedicated affirmative insurance solution, offering up to USD 1 million of cover, for unbudgeted operational costs. It complements P&I insurance by directly addressing the operational risks of detention and delay following routine U.S. port state inspections.

Athens War Blue Card Insurance

For cruise lines and ferry operators, passenger liability compliance isn’t optional — it’s mandatory regulatory compliance.

Marine Cyber Insurance (MCI)

Cyber risk is both a regulatory and operational reality. ShorelineHudson’s bespoke Marine Cyber Insurance provides affirmative cover against business disruption, liability, and regulatory penalties while supporting compliance with emerging cyber risks such as GNNS jamming and AIS spoofing. This protection safeguards both operational resilience and corporate reputation.